The application of Model-Based Systems Engineering – business models and the vehicle experience – ep. 9 Transcript

In this ninth episode of the Model-Based Matters podcast series, our experts discuss the business model change and the impact of the vehicle experience in the automotive industry.

We are speaking again with Tim Kinman, vice president of Trending Solutions and Global Program Lead for Systems Digitalization at Siemens Digital Industries Software. In addition, we are privileged to talk with Nand Kochar, Matt Bromley and Doug Burcicki, also from Siemens Digital Industries Software, each providing their expertise on this subject. Enjoy reading the podcast.

Check out the transcript (below) or listen to the audio podcast.

Read the transcript

Nicholas Finberg: Transportation isn’t just the vehicle anymore, you’re definitely selling an experience, you’re selling a service to the people. And in that same vein, I want to get to another topic as companies are starting to sell the experience, the service of driving instead of the car itself, maybe switching to different financing structure. How does that impact service of these vehicles? Are you more likely selling the services to people to continue the revenue stream? Or are you trying to sell them new cars when updates happen? This might be different for different types of industries. It’s definitely going to be different commercial where you’re not going to want to have as many trucks on the road.

Tim Kinman: The purchasing experience has changed. You are buying mobility. And, you may or may not be driving. As Nand said in the previous podcast, it could be completely autonomous, you may or may not be driving but your business model is; for one, I get the base, I get from point A to point B, but the other elements that I may buy in there is maybe around the connectivity of my experience. But the service part, that’s a good question; how does service change if it’s a fleet-based model?

Nand Kochhar: I mean, there are so many different business models, and they are each chunked differently, because at the end of the day, everyone wants to be profitable and have to make money out of these new business models. And that’s the exciting part of what is going on in the industry. So, you can chunk it out with companies like Ubers and Lyfts.

They’re trying to get to the autonomy and technology to get the driver out of the system because that’s a big piece of the cost – the driver. So, that’s one level of it. I think we all touched on fleets. So, the trucking industry has a challenge of finding the drivers. And getting to some level of autonomy in the trucking industry is a huge business case. Now, having a customer-level, SAE Level 5 autonomy might be out there. It’s not their immediately. But if you put the geofenced arenas or SAE Level 4 autonomy, that’s already out there today, in some cases. This is where you have to switch the industry as well. So, go into the agriculture industry, as they are driving all of the autonomous stuff that is needed for that industry. Because, by definition, it’s some level of geofencing in repetitive operations, and they are getting business benefits, whether in terms of the predictive maintenance of their fleet or whether it is getting more farming done using these features/functions. So, it doesn’t have to be the automotive industry. You can do learnings across these industries, whether it’s aerospace for one certain amount of things, light weighting of the materials, electronics and aerospace and the 5G impact. In the farming industry you see many new business models being developed as things evolve.

Doug Burcicki: Just want to add on to that from maybe a slightly different perspective. If you look at passenger cars, many of the new entrants that are trying to come to market don’t have brick and mortar facilities. They’re selling their vehicle over the internet via an app or a web interface. And they service the vehicles. They may have mobile units that come to your house or your place of work. Well, they need to know what’s on that car by each event. And, especially, as was mentioned before, if there has been software updates or revisions that have been procured since that vehicle has been purchased, you can have two identical vehicles that are very different based on what features have been subscribed to or not. That’s a lot of information. Does that information reside within the van that pulls up in servicing millions of vehicles that have been built by that OEM over the last couple of years? Or, is it contained within each vehicle itself, and it has a data set within it that knows exactly what’s happened, what change revisions taken place, and how they impact each other? That’s a very different answer, and how it’s realized is different. But the reason I bring it up is because it’s an extension of the same MBSE methodology. You’re going to leverage that same data set you designed and built that vehicle on, and components were built and procured on. So, it really is an extension of the same data set. So, I see that changing and becoming a very important thing in the future.

Tim Kinman: So, Doug, if we change our minds about what that service facility may look like for an electric car, you don’t have the grease and oil elements of it as there are fewer parts. Therefore, your view of a service experience may be more of a Best Buy/Geek Squad scenario in the future, rather than the traditional view of what service really looks like?

Doug Burcicki: Absolutely. And your service center may have a nice boutique cappuccino or espresso machine. And you get a massage while your car’s getting its latest charge on its battery and software download, and then you’re off and running again. So, yeah, it’s definitely changed. But the other service aspect, and Nand touched upon this as well, when you get into fleets, and that is downtime is loss of profits. So, when you have connected vehicles you’re learning from previous vehicles in the fleet and the use of those and how they’ve performed or haven’t performed well. Then you get into predictive maintenance, and you’re bringing these vehicles in, and you’re servicing them before they break down or before they have issues that take them out of their service operation cycle. And they become profitable, much more quicker over the life of that vehicle. So, it’s a wiser investment for those fleet operators. Again, this is an extension of the same data set that the vehicle was built on. You are going to see automatic extensions of the data into the service life of these vehicles because they’re going to be around for 15 years. And I don’t know of any paper and pencil process that’s going to keep up with the software complexity and changes that’s going to take place over that 15-year period.

Tim Kinman: And the onboard diagnostics won’t be onboarding anymore. It’s all cloud-based, too, right? So, when you pull into the service center and you say to that technician, “Oh, yeah, I just happen to hit a small bump.” They’re gonna say, “Uh-uh, we know where you’ve been. We know what the vehicle was doing at the time. We know everything about it.” It’s gonna go right to the heart of a much broader view of the diagnostic that tells you whether I really have a physical ailment or software issue. Just like we said, the service center in the future, basically, it tells you, “You better come in because we know you’ve got a problem, even if you don’t know it yet.”

Nicholas Finberg: They would be able to easily tell, “So, your vehicle is operating off the average of the rest of the fleet. Maybe something’s wrong.” Even if you don’t know specifically, something happened.

Tim Kinman: Yeah, because your vehicle is IoT-enabled, and by the models that are already released with a vehicle, it knows that you’re not performing within the design parameters of the vehicle, and it will tell you that you need to go into the service center. Also, “can we schedule a spa appointment while you’re there?” It will set that up for you as well.

Matt Bromley: A question for Nand Kochhar: I think a lot of those business models are already in place in things like the mining industry, where you don’t buy a 100-ton earthmover, you buy the capacity to shift a certain amount of Earth as a service, and then Caterpillar effectively provides you the vehicle to do that. But, as you said, it’s all IoT connected, so they can do the preventative maintenance, they can ensure the uptime. And really, as a business model, you’ve already transformed from owning a vehicle to owning the capacity to move a certain amount of rock or whatever.

Nand Kochhar: Absolutely, mining is a good example. I didn’t want to get too far away from automotive. I used agriculture industries. Mining is, again, geofenced, it’s contained, both from a service model. You’re spot on, Matt, that’s what they’re already using at Caterpillar. I learned another interesting fact without naming the automotive company, or in fact the farming equipment company, between Illinois and Iowa on those highways. They have these during the harvesting season because there could be part failures. They have spare part trucks running throughout that corridor within X number of miles. So, when farming equipment is down, they don’t have to wait for getting a part from a depo out in San Francisco or somewhere else in Texas. The timing is absolutely critical. So, people invent these business models. Someone has performed the calculations and having these trucks running around with spare parts with an X number of miles is a better business than letting the machine be down and the farmers not able to harvest during the harvesting season. So, that’s what I meant by innovation. It’s exciting times because now everyone has the ability through all these data insights, as we talk technical sensors and IoT. But at the end of it, it is all that information and insight you’re getting, and then you’re making decisions out of those insights and as the ultimate business driver. I think that’s where the data analytics, IoT, all come together and deliver results.

Matt Bromley: So, basically, we can expect the maintenance truck to turn up at Tim’s house and say, “We fixed your car for you.” You didn’t know it was actually needing maintenance. And it’s a free service because you didn’t actually buy the car. What you bought was the capacity to drive 12,000 miles a year.

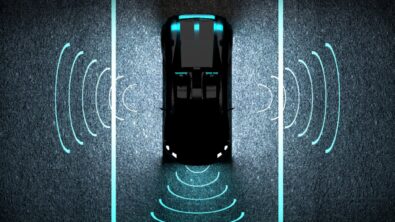

Tim Kinman: Yeah, and I think you’re not that far away. When you go to sleep at night, Tom’s vehicle goes to the service center while you’re sleeping, and you wake up in the morning and it’s back. So, Nand, another business thing I want to come back to is the fleet in the trucking because I know – and you can tell me as much more about this too – but in Arizona, in Texas, they seem to be much more advanced about allowing distribution through autonomous technology. And the one thing that came out to me was that they said, “Even though there’s still some human oversight, the truck is doing everything, but they’re still required to do some human oversight.” The byproduct of that is they said they discovered that they’re saving 10 percent of fuel cost purely by having the autonomous truck do it even if there’s a human in the cab because the sensors detect cars ahead. The sensors are just better drivers. So, you’re seeing the same thing as Arizona and Texas as they seem to be much more advanced in what they’re doing.

Nand Kochhar: Yeah, in fact, not only in the trucking industry, you know that in Phoenix, Waymo already did those pilots of autonomous driving. So, it wasn’t open to the public yet. In the first set of pilots, they’re more progressive-thinking people who are open to this technology. So, they signed up for that, and they will get autonomous shuttle rides within the city from their Waymo fleet. And they were open to sending their kids to schools using those fleets. So, you’re absolutely right, certain parts of the country is doing those pilots. And being the auto-industry hub in Detroit, we had Domino’s Pizza do the delivery within an urban area, which is close to their headquarters (a few years ago), combining efforts with Ford and Domino’s and autonomous vehicles, providing driverless cars for delivering pizza. So, you see that things are opening up, people are adapting. As you know, any of this technology adoption is not just purely technology, it’s everything else; it’s the policy, it’s the safety, and it’s the public, whether they’re open to that or not. So, Tim, you’re absolutely right, certain states are progressing much more.

Doug Burcicki: Important thing to remember: number one, from a technology perspective, Arizona and Texas are pretty attractive states from an autonomous vehicle development perspective. It’s ideal weather and road conditions. You don’t have potholes. Right now, I can’t drive five miles from my house in Michigan without evading mines everywhere I go. It’s just incredible, the depth of destruction of the roads from the winter here. But you couldn’t run an autonomous car in this environment now. So, those environments are picked for a reason, and we all know that. But what is interesting, and this goes back to that business model that I talked about at the beginning, is it was no accident that that corridor from California to Texas and Arizona was picked by Aurora. And the US Postal Service, and UPS were chosen because they man those things with two-man trucks that run 24/7. And they’re low traffic environments that are relatively straight shots.

And if there’s a perfect environment, automate something, that’s it. So, they’re like, “Let’s start here, low-hanging fruit.” To your point, the fuel efficiency alone pays for the oversight of a driver sitting there, and then they got some good technology foundation to build on. Nand brought up the geofenced locations and environments like hospitals and universities for shuttle services, so things like that are clear candidates for fully autonomous systems but I think you’ll see true deployments in commercial vehicle and heavy equipment sectors before you and I are dropping our kids in autonomous cars to take them to school anytime soon. And it’s because the business models justify the investment in those sectors where you and I don’t have to shell out twenty grand extra to have autonomy on a vehicle in our driveway.

Nicholas Finberg: Yeah, the fuel savings are definitely a very interesting point nowadays. There are so many people trying to make transportation more sustainable, whether it’s fuel economy or reduced weight within the cars themselves, complex machining processes have really changed. And, how does its transition to Scope 3? How do the things that I bought for my supply chain impact my overall greenhouse gas emissions? How do the suppliers’ impact that? And I think MBSE is a tool for connecting those sources of data; how is the emissions from my steel producer into the actual impact of my body? The traceability impact for MBSE on sustainability.

Nand Kochhar: You touched on sustainability, which is very important for the industry. And it is not just for the sake of ithe things we touched on, like emissions and so on; because there’s a true business value to be sustainable, you must look at it beyond merely zero emissions coming from the vehicle, as you have to look at the entire manufacturing footprint. Any kind of waste – taking waste out of the system is part of that sustainability. Where you make your make-buy decisions or geographical locations, and what’s the landed cost is a huge factor taken into account from a sustainability perspective as well. So, you have sustainability targets setting the process, which is very similar to our traditional automobile performance setting process. When you design a vehicle, you do your power packs collection the same way as sustainability – your target setting process. To deliver your goal, it must cascade those to the entire ecosystem, and then bring them back together on the systems engineering – the other right side of the tree; how you’re delivering to those targets you have to establish. So, yes, an MBSE approach is very applicable to deliver sustainability objectives as well.

Matt Bromley: The component to sustainability is supply chain resilience, right? I mean, it’s the same argument, with particularly automotive, about chip shortage and that having a dramatic impact on production. So, when you’re engaged in the earliest stages of design, being able to understand how the supply chain is going impact that design, and whether or not we touched a little bit on safety and security, and whether all the elements of your supply chain are trusted and traceable so that you know they are going into the vehicle with a level of assurance, so you can guarantee the same thing for the product as it moves down through the production process regimen; “Is my entire vehicle trusted from all the elements that come together from a supply chain perspective?” It’s clearly a very large topic on the micro electronics side. But, it really impacts every sort of make-buy decision that you’ve got for the entire vehicle.

Nicholas Finberg: Yeah, that’s an awesome way to wrap up. I want to thank all of you for talking with me today. This is awesome. We’ve covered quite a bit of information on automotive and what’s changing, and a lot of things that I wasn’t expecting to hear about today. So, thank you all for joining me.

Siemens Digital Industries Software is driving transformation to enable a digital enterprise where engineering, manufacturing and electronics design meet tomorrow.

Xcelerator, the comprehensive and integrated portfolio of software and services from Siemens Digital Industries Software, helps companies of all sizes create and leverage a comprehensive digital twin that provides organizations with new insights, opportunities and levels of automation to drive innovation.

For more information on Siemens Digital Industries Software products and services, visit siemens.com/software or follow us on LinkedIn, Twitter, Facebook and Instagram. Siemens Digital Industries Software – Where today meets tomorrow